Claims Management & Adjusting Ltd. (C.M.A.), established in 1994, is the UK’s oldest company of loss adjusters specialising in vehicle-related claims. A claim for a vehicle owner/user is often traumatic resulting in distress, inconvenience, and financial hardship. Our knowledge and experience are utilised to address claims efficiently.

Are you involved in a vehicle claim? Please visit our HELP page – there is much you can do to ensure the matter progresses without delay.

| Theft | |

| CMA started life in 1994 and was known for addressing vehicle theft claims. We have a wealth of experience in the arena. A director is a member of IAATI. We all hope that a stolen vehicle, for example, will be found undamaged by the police, and returned to the owner promptly, however, this is less common these days. | |

| RTC | |

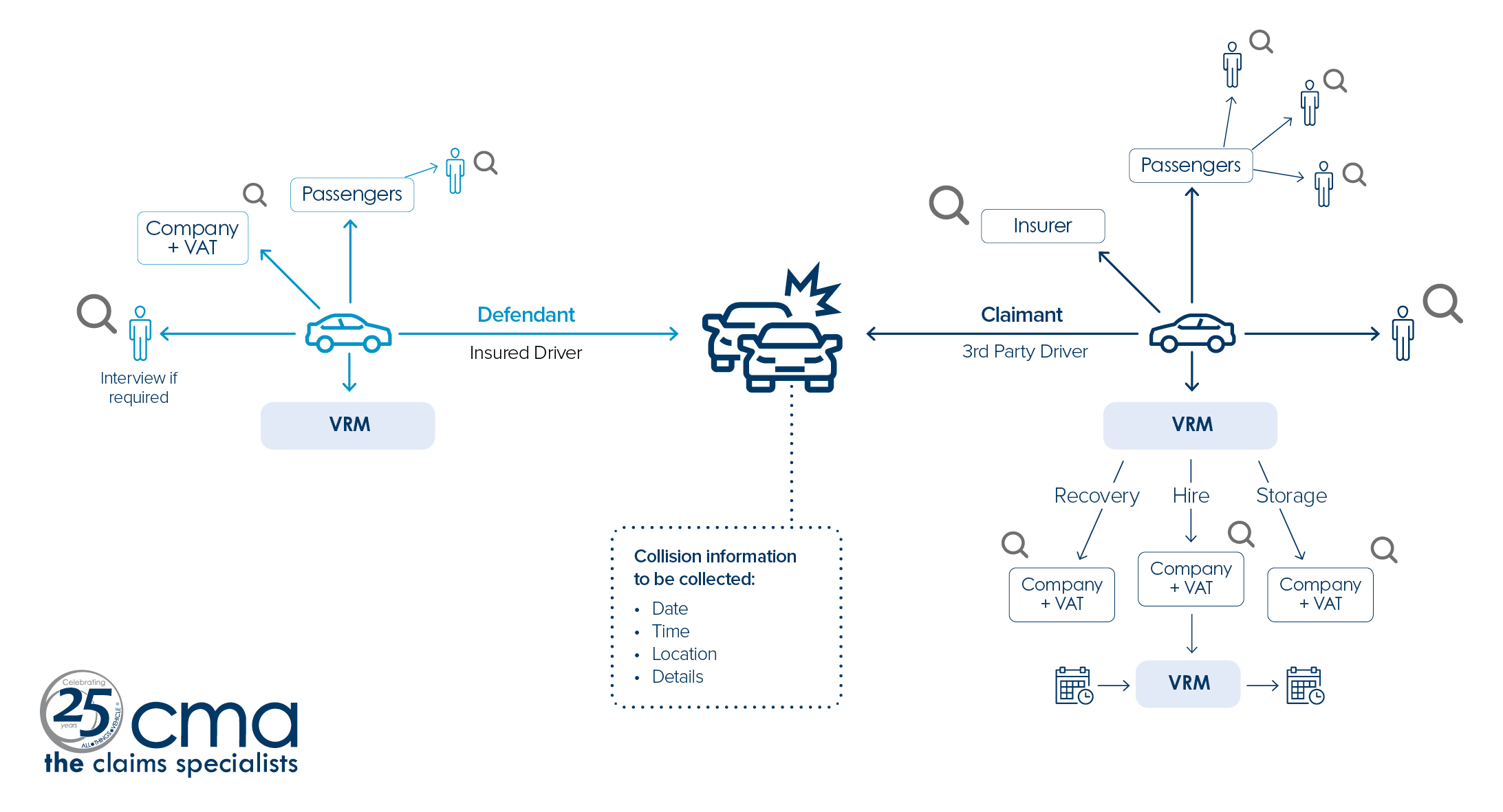

| Road Traffic Collisions. 1995 saw our expertise utilized by World in Action as we assisted with the investigation of a notorious ARC (accident repair centre). Subsequently, we have been asked to help establish liability and quantum in 1,000’s of vehicle collisions, spills, and fires that have resulted in everything from minor damage to major incidents, on occasions, fatalities. | |

| TPPD | |

| Third-Party Property Damage. On occasions, the total loss vehicle is the least of an insurer’s worries … the property they strike can be more costly and time-consuming to resolve. | |

| Highway | |

| National Highways or Council Claims Following Collisions, Spills or Fires. Having caused some contractors to change their practices, we are now moving to an era of National Highways controlled claims. The issue is less the rates utilized and more the amount of them applied! Some Councils appear not to understand their own contract or how their contractors are operating. | |

| Fraud | |

| Since the mid-90’s we have been associated with fraud investigation. Our understanding of vehicle and personal data means we not only identify anomalies but can substantiate or negate them. | |

| Dispute | |

| Stolen, Financed & Total Loss Vehicles acquired by ‘innocent purchasers’. Whilst the significance of these matters may not at first be apparent, since the mid-90’s we have handled 100’s of claims for title disputes (theft & finance) and diminution in value (total loss & clocking) claims. We have long assisted vehicle information suppliers and innocent purchasers of vehicles with ‘odd’ histories. Our comprehensive, unique understanding of vehicle documentation, processes, and data is used in our day-to-day claims handling. | |

| e-Scooter | |

|

At the time of writing, in late 2022, e-Scooters cannot legally be driven on our roads unless rented under an approved scheme. But this has not prevented 1,000’s from being ridden unlawfully, the owners/users facing confiscation, prosecution or injury – to themselves or others. |

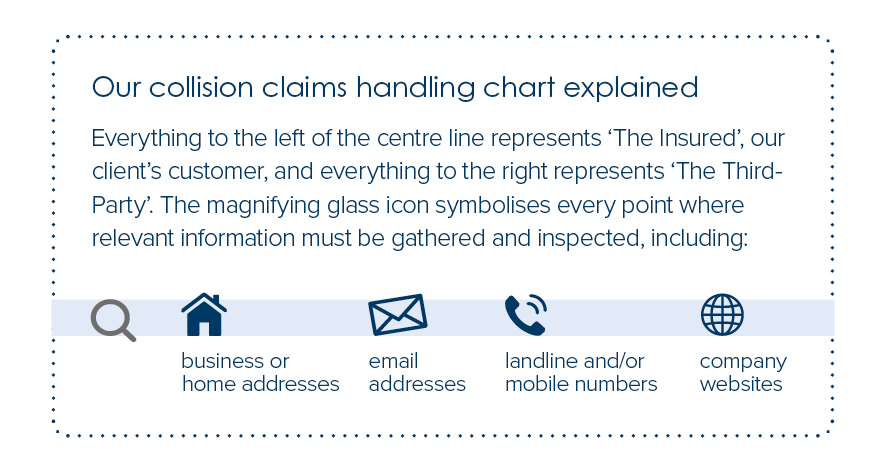

Vehicle Claims are seldom as straightforward as they may appear, even a seemingly simple two-vehicle RTC presents multiple aspects to consider: